Agricultural economists manipulated data to block Congress from acting on high beef prices and the destruction of independent cattle ranching. Why? Because they think monopolies are good.

| Matt Stoller | Oct 15 | 81 | 64 |

Welcome to BIG, a newsletter about the politics of monopoly. If you’d like to sign up, you can do so here. Or just read on…

Last week, there was what should have been a historic hearing in the House Agriculture Committee, with the goal of reforming America’s cattle ranching system. The first witness was a Republican Senator trying to persuade the House members to adopt his legislative initiative. “My name is Chuck Grassley,” he said, “And I’m a farmer from Butler County, Iowa.” Grassley’s homespun rhetoric disguised a sophisticated and longstanding campaign to address a crisis in the beef industry, and more broadly, our food system at large.

To consumers, this crisis appears as high meat prices, with costs for beef up 12% this year alone. “I’ve never seen it like this in all the years I’ve been doing this,” said Bob Strupeni, a butcher in San Francisco who has been working in the industry for 44 years. Higher meat prices are responsible for roughly half the annual increase in food prices, and food inflation is not only stretching household budgets, but has created a serious political problem for the White House. In September, the Biden administration attacked the industry over high prices, calling for an end to “pandemic profiteering.”

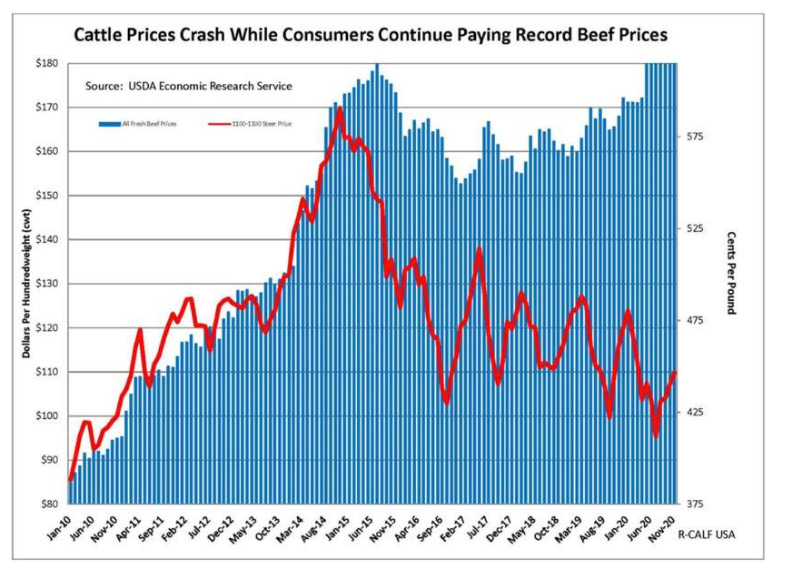

To cattle ranchers, who actually sell the cows to packers that are turned into beef, the crisis is not high prices, but low prices. They aren’t getting very much for their cattle. This is weird, because, normally, beef and cattle prices move in tandem – the current high beef prices should result in high cattle prices. But since 2015, the ‘meat margin’, or the spread between the prices ranchers get for their cows and the prices consumers pay at the supermarket, has widened dramatically. Despite high consumer prices, independent ranchers are losing money, and going out of business. “If we don’t get some of these problems fixed quickly, we won’t have any independent ranchers in this country,” explained Oklahoma Farmers Union president Scott Blubaugh.

Why are there high prices to consumers and low prices to cattle ranchers? Grassley had an answer. “The four major beef packing companies control 80% of the cattle industry,” he told the House members. And they are what he called “a chokepoint” for the entire sector. In other words, follow the money. In the beef industry, it’s not Amazon, Apple, Google, and Facebook suppressing business, but “the Big Four” – Tyson’s, JBS, Cargill and National Beef, who control 85% of the market (and more in some regions).

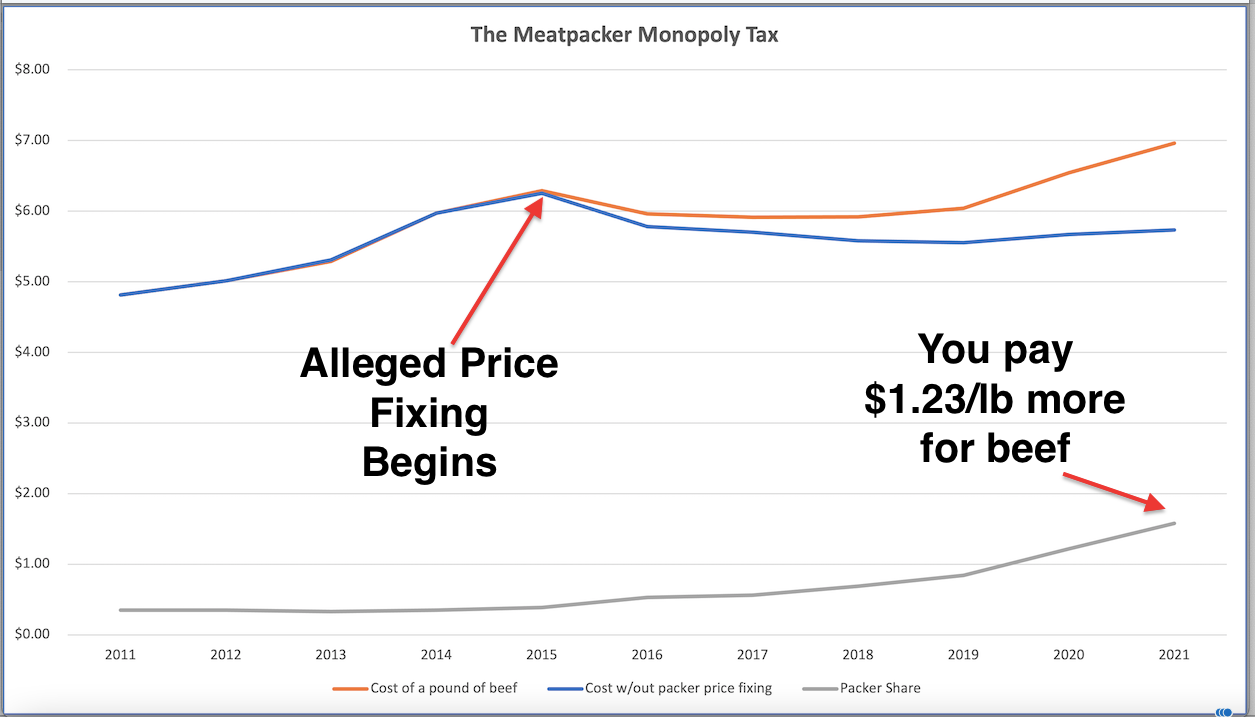

Grassley’s chokepoint comment is right; for every dollar Americans spend on food, only 14.3 cents goes to the farmer. And much of the rest of it goes to the middlemen. JBS, for instance, paid out a record $2.3 billion in dividends in 2020, and plans to increase that by 75% this year, even as cattle producers leave the industry. Here’s a chart showing the meat margin. The split between beef and cattle prices starting in 2015 is very clear.

With such stark disparities, the politics of beef are lined up for major change. Consumers are upset. More importantly, ranchers, who are a fractious bunch, tend to have wealth and connections, and they have for the first time unified around a core agenda of making packers disclose prices paid for cattle. They have also persuaded large numbers of Congressmen to act on their demands. Bitterness between ranchers and packers is so bad that JBS exited the National Cattlemen’s Beef Association, a politically powerful trade association. Schisms in industries like this don’t happen often, and when they do, they mean reform is on the table.

How Beef Markets Work

Is there really an emergency in the supply chain, or is this just a fight over money between well-off ranchers and massive multi-nationals? The answer is that there is a serious problem that goes beyond parochial concerns. Back in May, I interviewed independent ranching advocate Bill Bullard to talk about something that hadn’t happened in America since World War II – a beef shortage, along with accompanying high prices. Like a lot of shortages, it’s easy to chalk this one up to Covid. But in fact there was plenty of cattle, it just wasn’t getting to the shelves. So what was happening?

One hint is to look at packing plants. In the late 1970s into the early 1980s, beef packers consolidated as a result of policy. The Reagan administration facilitated a large merger wave, and the courts threw out a consent decree going back to the 1920s that blocked packers from engaging in a variety of anti-competitive practices, such as owning their own feed lots. The result was the re-creation of a new oligopoly that had been taken apart in the 1920s, a set of dominant firms profiled by Upton Sinclair in his 1906 book, The Jungle.

During this consolidation craze, dozens of smaller packers disappeared, either purchased or driven out of business. Entering the market as an independent packer no longer made sense, because an existing packer could simply drive you out of business through things like below cost pricing, or making your products not viable by intentionally losing money to drive you out of business. Or they could sign exclusive distribution agreements with supermarkets or significant buyers, meaning that you would no longer be able to have access to potential customers. In addition, packers began mass imports from Mexico starting in 2009, using a loophole to label such beef as “product of U.S.A.,” meaning it was harder and harder to compete.

It’s fairly clear there would be new packers if it weren’t for anti-competitive tactics. Indeed, Walmart, which doesn’t fear retaliation as it is itself a large beef retailer, looked at this situation, and realized that it makes more sense to become a meatpacker itself than to buy from the middlemen who inflate costs. The retail giant got into the packing business in 2020. Walmart is not good for independent ranchers, but that the chain entered packing is an illustration of how bloated the cost structure is of existing players.

Along with the consolidation came plant closures. From 1977 to 2014, packers closed over 200 packing plants. Plants did get bigger and more efficient, but overall capacity declined, and the product lines became less flexible. In 1989, industrywide slaughter capacity was 145,000 head/day, vs. 128,000 head/day in 2014. There hasn’t really been enough meat-packing capacity since 2016, though this has been overcome by running plants around the clock. Running plants continually does lower costs, but there are trade-offs. Cattle producers now have to travel further to get their cattle to the smaller number of packing plants. There’s also a loss of resiliency. And in 2019, a large Tyson plant burned down in Holcomb, Kansas, causing significant problems. And when Covid created a supply and labor shock, actual beef shortages emerged, because there was no slack capacity.

The shortages aren’t what angered the producers. Problems in the industry go back years before Covid. Ranchers suspect that the Big Four have been fixing prices to lower what they get paid. This market-rigging took place over time, as the packers gradually forced changes in how cattle markets work. Traditionally, cattle ranchers had sold their cattle at open cash markets where they would display their cows, and packers would bid for them. It was a rich, thick market, with information about prices displayed very clearly to buyers and sellers. Such markets are hard to rig.

But in the mid-2000s, packers began using what are called captive supply deals. Under a captive supply deal, a rancher signs a contract with a packer. He will no longer take his cattle to an open market, but will raise it and sell it to that buyer. Basically, ranchers get a guaranteed sale, while packers get a guaranteed source of cattle. Or that’s the theory. Because there’s still the matter of price. To figure out what the packer should pay, these deals usually just say that the packer has to pay whatever the price is in the normal open cash market.

At first this was fine, since there were plenty of cash markets with lots of buyers and sellers. But packers began signing more and more of these side deals, sometimes with an ‘offer you can’t refuse’ kind of mentality. And that meant there was less and less cattle in the cash market, until virtually nothing was bought or sold in the open. The cash market, now just 20% of all sales, became what is known as ‘thin,’ meaning there’s a lot less bought and sold. Thin markets are a lot easier to manipulate; a buyer could just pull out of an auction. That doesn’t just lower the price paid in that cash market, but also the cash price for all the captive supply contracts as well.

With this kind of system, it’s extremely tempting for packers to push prices down in thin markets, and thus lower their costs for all their private side deals as well. And in fact, that appears to be just what the packers did. They pretty much announced it publicly. In 2015, for instance, a Tyson executive said on an investor call that “because we run for margin and not market share, we’re not willing to overpay for cattle.” At around that time, a JBS executive praised industry-wide plant closures, saying it left them in a “very good position” to achieve balance. These kinds of comments from insiders at the Big Four became somewhat routine around 2015.

More importantly, in a recent antitrust suit, class action lawyers found multiple insider witnesses who explained that the Big Four colluded to keep prices paid to cattle down. One witness described a conversation with the head of fabrication of a JBS plant in Texas, in which he was told “that each Defendant expressly agreed to periodically reduce its purchase and slaughter volumes to reduce the prices they would pay for fed cattle.” Another noted that the packers “worked together to reduce their purchases of cash cattle” because they realized that taking cattle out of the cash market would lower prices. “This reduced cash price,” the witness noted, “together with an interlinked depression of the Live Cattle Futures prices, lowered the price Defendants paid for all the cattle they purchased, with cash or otherwise.”

These witnesses were sufficiently credible that the judge accepted the complaint and sought a quick move to trial, which is very difficult under today’s elevated antitrust legal standards. Still, it shouldn’t be a surprise that there’s price-fixing in beef, as such conspiracies are common in other agricultural areas. In the tuna market, the CEO of Bumble Bee went to jail for doing just that. In many ways, that’s the point of consolidation and getting rid of cash markets in the first place.

To remedy the crisis, Grassley, as well as a bipartisan group of Senators, introduced a bill that would require packers to buy at least 50% of their cattle on the open cash market, essentially returning the industry to the healthier state prior to the mid-2000s. That bill is what Grassley sought to push in front of the House Agriculture Committee last week.

Enter the Economists

The hearing should have driven a consensus towards action. But two days before the hearing, a small group of economists centered around the Agricultural and Food Policy Center at Texas A&M University, with support from the Department of Agriculture, released a report on the beef supply chain, with anodyne name “The U.S. Beef Supply Chain: Issues and Challenges.” And this book stopped the movement for reform dead in its tracks.

So what did this book say and why was it so effective? These economists argued that the cattle ranchers had it all wrong. The Big Four were large, but that size was merely a result of superior productive efficiency. And while cash markets were much more limited than they had been, prices were still determined solely by the impersonal forces of supply and demand, not market rigging. Moreover, these economists issued a serious warning to members of Congress considering reform. Any policy action would cut into this efficient system, and “produce numerous and detrimental unintended consequences,” especially to the naive cattle ranchers asking for the government to step in.

One particular economist, Stephen R. Koontz, wrote the most important chapter. Koontz gave a specific number to the warning. Grassley’s preferred policy intervention, Koontz argued, would cost cattle producers $16 billion over 10 years.

The Meat Institute, the lobbying association that represent the packers, had until that point been outgunned by the angry ranchers. But blessed with the scientific authority of economists, the packers immediately centered their objections to reform around this report. And it worked. Instead of a hearing moving towards action after years of advocacy by ranchers, the Chair of the Agriculture Committee, an Atlanta Democratic Congressman named David Scott, opened the hearing by praising what the economists had found, and warning of the possible $16 billion loss. The headlines coming out of the hearing shows what happened – a lack of consensus, leading to inaction.

How Economists Manipulated the Data to Aid Monopolists

It was a remarkable moment. Clear evidence of market rigging presented to a court, a significantly expanded meat margin, and angry ranchers explaining what was happening, were somehow no match for the economic scientists.

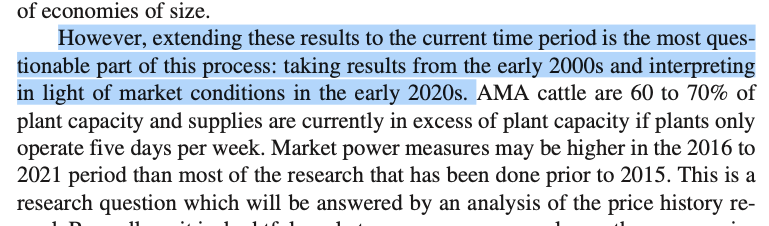

How did Koonz make the case that bringing back cash markets would be so immensely costly? It’s simple. He manipulated data. Koontz looked at a study of what happened in cattle markets to see if prices were done fairly under captive supply agreements. And he found that everything was fair. Consolidation and secret agreements, he concluded, didn’t affect prices.

The problem is, he looked at data from 2003-2005. In those years, most buying and selling happened in open cash markets and there was plenty of packer capacity, so it was much more difficult to manipulate prices. Using those years as a comparison for what’s happening now simply doesn’t make sense. I’m not just asserting this. Koonz himself put a caveat in at the end of his essay saying that his results aren’t particularly credible.

There are a lot of other weird nuggets in the economic book, caveats undercutting their main arguments. The authors note, for instance, that the supply chain is inflexible and dangerous, but dismiss that point. They admit they lack important data to understand what is happening with prices. And they use now-discredited models. But in one area they didn’t lack confidence, and that area was recommending to policymakers to let the monopolists alone.

Ending the Tyranny of Economists

Typically, we imagine Washington D.C. as a corrupt cesspool, with campaign contributions dominating the landscape. And to some extent, that is true. But politicians aren’t the villains; they do respond to voters, and are often able to ignore multi-national firms like JBS, as powerful as such corporations seem, when their own constituents are upset. But politicians also listen to economists, because they think economists are disinterested scientists.

But economists are not disinterested, they are a key ideological center of monopoly power. Economists at the Federal Trade Commission, for instance, are the main reason the FTC didn’t pursue an antitrust case against Google in 2012, when it would have made a huge difference in the development of the mobile web. (Economists made absurd predictions, like assuming few people would ever use search engines on their phone.) As another example, the economist Carl Shapiro, who spent years at the Antitrust Division during the Obama administration, explained that the government didn’t bring any monopolization cases during his time because there weren’t any monopolies in the U.S. economy. It’s perhaps an overstatement, though not by much, that economists are why we have a monopoly problem.

In fact agricultural economists, as it turns out, seem little different than the economists who enabled big tech. Both use models showing that market power isn’t a problem, both ignore fraud and/or market rigging, and both have a basic view that they are scientists, and the rest of us, well, aren’t. Indeed, the economists at Texas A&M started off chapter one of the book by telling cattle ranchers lack credibility because they are driven by rash sentiment. “As economic pressures intensify,” it said, “reactions tend to move away from the objective and toward the emotional.” It’s simply astonishing that clear evidence of price-fixing never entered into their minds, because it doesn’t have a place in their models.

And this isn’t even the first time that agricultural economists have ruined an industry. In 2008, Obama went around Iowa promising to look into consolidation in the chicken industry; when he took office, the Agriculture Department held some hearings, and the Department of Justice, all the way up to Eric Holder, promised action. Koontz, along with the packers, lobbied heavily against it, and Scott led the campaign to roll the Obama administration. Their campaign worked. Chicken farming is now entirely done by contract farmers, who essentially just work for one of the poultry processing giants. And it is beset by price-fixing. Tyson itself recently settled claims on chicken price-fixing, and has faced charges of wage-fixing in poultry plants.

The cattle market is going the way of poultry, towards entirely corporate cattle ranching. And the same economist who ruined the chicken industry – Koontz, and the same politician who listened to him in doing so – Scott – are now working to destroy independent cattle ranching and vertically integrate the industry. But it’s not gone yet. And fortunately, many of Scott’s colleagues did discuss the market power problem. The economists are losing influence.

A Path Forward

Economics and antitrust enforcement in general is in a crisis of legitimacy, because it has been forty years since there has been much meaningful enforcement. For decades, judges, enforcers, and members of Congress have deferred to economists, because they think that economists are scientists who understand how to make the economy efficient.

Most policymakers fear being mocked by economists as not understanding what’s going on, as economists cloak their lobbying efforts in math and their sloppy thinking in boring tones. You can even see it in the way these economists frame their arguments to politicians, explaining away the anger that normal people feel about these commercial systems. “It is reasonable to ask why the beef cattle industry should be plagued with so many contentious issues that have persisted for so long,” wrote one economists in the opening chapter of the book on beef supply. “Much of the reason is attributable to the fact that the U.S. cattle and beef industry may well be the most complex set of markets in existence.” It’s all just so complex and ranchers can be so emotional.

Fortunately, this dynamic is changing as a new generation emerged. Lina Khan, who now runs the Federal Trade Commission, made her scholarly name by noting that economists should not have control over antitrust law anymore. And her very first action was to address cattle imports and fraudulent labeling by packers. Meanwhile, Jonathan Kanter, a progressive foe of big tech who was appointed to run the Antitrust Division, just got a nominating hearing by the Senate in which Senators from both parties showered him with praise. Chuck Grassley, among other Republicans, talked about the crisis among farmers, and said that he would vote for Kanter, in part, because he believes that Kanter will act.

The old guard of economists and policymakers in the bureaucracies are still powerful. There are still some old guard politicians who believe what they say. But increasingly, their arguments, at least in some quarters, are falling on deaf ears.

Thanks for reading. Send me tips on weird monopolies, stories I’ve missed, or comments by clicking on the title of this newsletter. And if you liked this issue of BIG, you can sign up here for more issues of BIG, a newsletter on how to restore fair commerce, innovation and democracy.

cheers,

Matt Stoller

P.S. I found one additional observation about agricultural economists interesting, but it’s pretty antitrust nerd-specific, so I’m putting it here.

Koonz’s work connects with big tech on a theoretical level. Prior to the 1980s, antitrust economists used what was known as the ‘structure-conduct-performance’ paradigm to analyze markets. Basically, they’d ask if markets were concentrated, and assume that if the answer is ‘yes’ then there was probably bad stuff happening. Starting from the Reagan era onward, economists stopped caring about industry concentration, and only focused on efficiency. Structure-conduct-performance became an object of ridicule, and firms like Amazon, Google, and Facebook, – because their products were free or low cost – were idealized by economists instead of recognized as monopolistic.

In his chapter, Koontz dismisses the structure-conduct-performance paradigm, which underpinned earlier forms of action against dominant packers. And he comfortably turns to the models from the 1980s, which largely dismiss market power concerns. It turns out, the same delusion that allowed Google to become a monopolistic force also enabled the packers to recombine into what Upton Sinclair warned us about.

UPDATE: I decided to play with data and create a spreadsheet showing how much of the extra cost of beef is going to the packers. I used data from this article, which is drawn from USDA sources.