Interesting observation by Charles Smith. Something that he only mentions is passing, and I believe is much more significant than people realize, are Ad blockers. I have not seen an ad in over 10 years and I cannot imagine there are not millions more like me and I cannot imagine if more people were even the least bit computer savvy the entire online advertising industry would dissolve into thin air. Either way, his other points are very valid.

Thursday, September 14, 2017

Hey Advertisers: The Data-Mining Emperor Has No Clothes

When a big advertiser pulls its online adverts and its sales remain unchanged, that tells everyone who’s paying attention something important.

It’s an article of widespread faith that data-mining enables advertisers buying online adverts to target consumers with laser-like precision. Vast warehouses of servers grind through billions of records of consumer profiles and transactions and with a bit of algorithmic magic, distill all this data down to the prime target audience for whatever good or service you’re selling: probiotic goo, battery-powered back-scratchers, Zombiestra(tm), investment newsletters based on darts tossed by monkeys, etc.

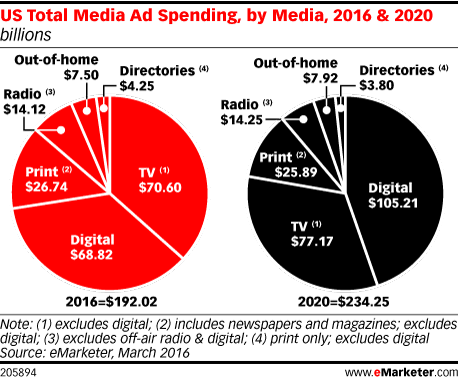

And everybody knows online media is the place every advertiser wants to be and needs to be. By some measures, online advertising exceeded television advert spending in 2016 (around $70 billion each). Unlike traditional media advertising, which is stagnating or declining, online advertising is still expanding smartly–especially in mobile media.

Combine the promise of god-like targeting via data-mining with fast-growing online platforms, and you’ve got advertisers falling over themselves in their rush to spend billions more on online advertising.

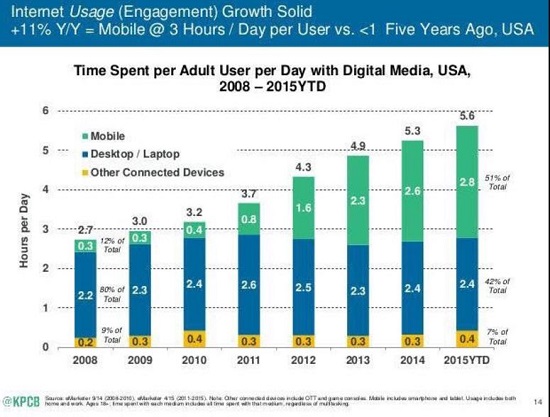

As if that wasn’t enough to get advertisers salivating, the time consumers spend online continues to expand as well:

There’s one little problem with this narrative: online adverts don’t work as well as they’re advertised. Proctor and Gamble recently announced that a significant reduction in their online social-media advert spending had no measurable effect on sales.

The only possible conclusion (unless you’re selling online adverts for a living) is: online adverts don’t work.

There’s another little multi-billion-dollar fly in the ointment of online advertising known as click-fraud— the clicks on adverts may not be humans actually interested in the product being advertised but automated bots skimming money from advertisers or competitors.

So all those clicks aren’t from actual consumers; they’re bots clicking on click-farm sites which send a small fee for every click to the owner of the site, which just so happens to be the owner of the bots clicking on the adverts.

Or an advertiser finds they owe $100,000 in click-fees for the tens of thousands of clicks their adverts garnered–but most of the clicks were generated by competitors seeking to bleed the advertiser of revenues and introduce false data points.

Click-fraud is the industry’s dirty little secret, and the numbers are kept secret lest the reality that the Emperor has no clothes gets out. Despite all the hoopla about mobile adverts, fast-growing market, blah blah blah, there is precious little real-world evidence that online adverts actually do the intended job of generating new sales and attracting new loyal customers.

Just look at the online advertising you’re being served. Do you get adverts promoting airline tickets to destinations you’ve just been to and that you’ll never return to, adverts promoting wrenches after you’ve just bought the only wrench you’re going to need in this life, etc.?

If this contextual advertising is the best that data-mining can do, it’s pathetically ineffectual. Assuming you haven’t installed ad-blocking software (another industry reality that is rarely mentioned), have you ever clicked on any of the adverts in the sidebars of your social media or email websites–except by accident?

But what about all those thousands of data-points Big Data has collected on us all? All our purchases, all our credit history, how much time we spend online, the sites we visit most often, and all the rest of the mind-numbing details of every day life.

All of this data-mining is predicated on a false assumption: that my past purchases predict my future purchases. Other than the most brain-dead conclusions–yes, I will buy gasoline again somewhere in the near future, probably at Costco, using either the Costco credit card or an airline mileage credit card–this data has little or no effective predictive value because our spending is tightly limited, controlled and prioritized, so there’s near-zero leeway for impulse buys or unplanned purchases.

Spending can be constrained by modest levels of disposable income (i.e. cash left after paying all the essential bills, existing debt, etc.) or by budgeting.

As for enticing me to buy gasoline elsewhere than Costco, or switching credit cards–you’re wasting your money. Giving me $1 off each gallon would work, but only as long as I got this enormous discount–a discount that will bankrupt the issuer in short order.

As for enticing me to switch credit cards–I tear up multiple card offers every week, and have done so for years. So the card offers are batting zero despite literally thousands of pitches via mail, print and online adverts. No “targeted ad” based on data-mining is going to change that.

I might switch if you give me back 10% of all purchases in cash, but that’s an offer that will bankrupt the card issuer.

The fantasy that’s repeated in every account of the staggering effectiveness of mobile advertising is this: I’m walking past a pizza shop and my mobile phone displays a coupon for that very pizza shop. Wow! Imagine the power of combining location with all the treasure trove of big-data-mining about little old me!

Here’s a credit card purchase from three years ago for a pizza shop–this guy is a pizza fan, no doubt about it. This advert is a statistical winner.

Nice, except that 1) I rarely eat pizza, and when I do, it’s generally at home; 2) I never buy meals on impulse, since that ruins my diet/fitness regime (and I’m too thrifty to buy meals on impulse anyway) and 3) my phone is often not with me, off or otherwise disabled.

What this tired narrative never includes is my dismissal of the advert as a matter of habit, and the possibility the advert alienates me in longlasting ways. Most of us never look at ads, and the more you make them intrusive, the more we hate the website, the advertiser and whatever product/service is being pitched.

Advertisers may have unwittingly poisoned themselves and their product/service. The net result of the data-mined, contextual, statistically targeted advert may well be a consumer who blacklists the pizza shop from then on.

This alienation is of course completely opaque to the data-mining software: there are no data traces left by blacklists/ alienation.

But the flaws in data-mining-yields-advertising-success are much, much deeper than this: human behavior is contingent on events that have yet to happen, and the decision process is completely invisible to data mining and algorithms.

Here’s some examples from my recent purchase history.

I recently bought an airline ticket to Switzerland. Whatever inferences the data-mining software might extract from this will necessarily be false, as the motivation was completely contingent and unpredictable: my brother was in a motorcycle accident, and he needed my help as his wife was hundreds of kilometers away caring for the grandkids.

Whatever inferences the data-mining software extracted from the meal I purchased at an Italian cafe a week later would also be intrinsically useless/ false as the only reason we went to that cafe was it was the only restaurant my brother could reach on foot with his cast and cane.

What inference could any software extract from this that would be useful because it was accurate? None. The situation, the motivation, every single part of the decision was intrinsically opaque to any data-mining software.

As for what else I bought in town–groceries, paid in cash–another zero for the data-mining software.

The only item of any value that I did buy, I bought through my brother’s account–another layer no software could possibly penetrate. Software will wrongly attribute the purchase to his profile, not mine, a totally false projection.

Virtually every inference that automated software attempted to extract from my spending would be worse than useless, as it would be misleading. The only inferences with a shred of accuracy–here is a consumer who randomly buys an airline ticket to Europe–is utterly useless to advertisers.

The only adverts that have any chance of working are the traditional variety that assume only one in 10,000 people will have a contingency-based need or desire for the product or service being advertised. So the adverts attempt to reach 1 million people in the hopes that a hundred might be interested and a handful might proceed further.

What advertisers who are shaking themselves out of the online-advert trance are discovering is that the data-mining advert Emperor has no clothes. The industry as it stands can’t identify which clicks are fraudulent or accidental, which ads actually trigger a sale, or which ads actually alienate potential customers.

When a big advertiser pulls its online adverts and its sales remain unchanged, that tells everyone who’s paying attention something important: the industry isn’t doing a very good job for the billions it’s being paid.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform($3.95 Kindle, $8.95 print, $5.95 audiobook) For more, please visit the OTM essentials website.